- Home

- >

- News

- >

- Company news

- >

- Cobalt Price Surge Pushes MIM Powder Costs Higher: The Rising Pressure on F75 and 1.4957 Alloys

Cobalt Price Surge Pushes MIM Powder Costs Higher: The Rising Pressure on F75 and 1.4957 Alloys

Introduction

In recent months, the global cobalt market has experienced a sharp and sustained price surge, disrupting supply chains across the metal and advanced materials industries.

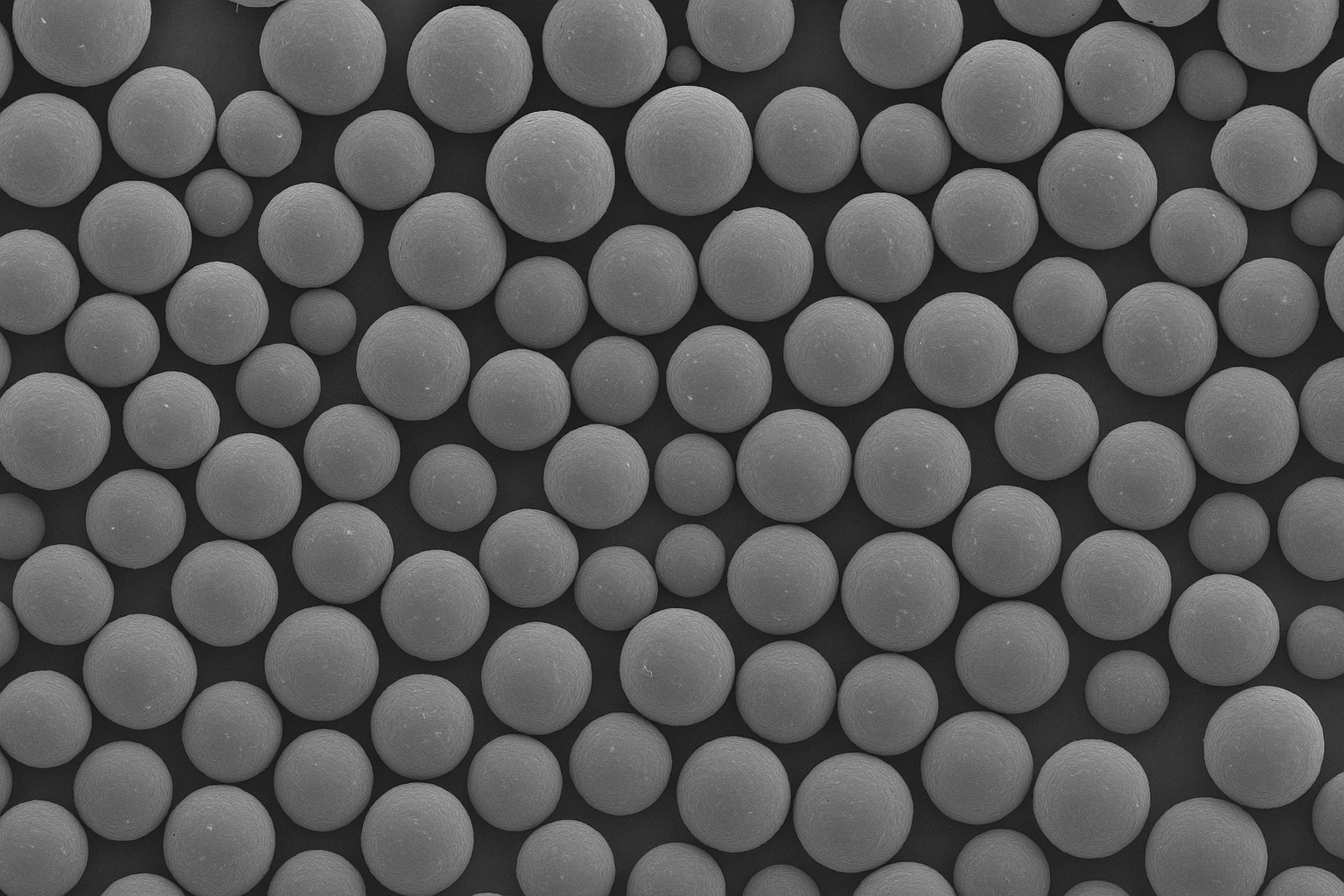

For manufacturers and users of MIM (Metal Injection Molding) powders, this price movement has had a direct and dramatic impact — especially for F75 (Co–Cr alloy) and 1.4957 (high-nickel, high-chromium stainless steel).

As a professional MIM powder supplier, we are witnessing firsthand how the cobalt rally is reshaping production costs, availability, and pricing strategies throughout the value chain.

Why Is the Cobalt Price Soaring?

1. Tightened Export Controls from the DRC

The Democratic Republic of Congo (DRC) — which supplies more than 70% of the world’s cobalt — introduced new export restrictions and quota systems in 2025 to stabilize the market.

Starting in October, the DRC implemented a 96,600-ton annual export quota, significantly limiting global availability.

This policy change, combined with earlier temporary export bans, immediately sent cobalt prices soaring to nearly US$38,000–40,000 per ton, reaching multi-year highs.

2. Persistent Demand from High-Tech Industries

Despite the growth of cobalt-free LFP batteries, EV batteries, aerospace, electronics, and medical sectors continue to rely heavily on cobalt for high-performance applications.

Chinese refiners have also shifted from cobalt hydroxide to metal dissolution processes, which intensified competition for refined cobalt metal and drove spot prices even higher.

3. Market Speculation and Supply Risks

Market participants expect cobalt supply to remain tight through 2026, with traders and smelters stockpiling ahead of further policy uncertainty.

According to TradingEconomics data (October 2025), cobalt prices have climbed to around US$45,650 per ton, representing an 87% year-on-year increase — one of the steepest commodity rallies of the year.

Impact on MIM Powder Materials

1. F75 (Co–Cr Alloy) – Direct Impact

F75 alloy contains a high percentage of cobalt, typically 60% or more, giving it excellent wear resistance, strength, and corrosion performance.

Since cobalt is the dominant cost component, any surge in cobalt prices immediately inflates the total production cost of F75 powder.

As a result, the current market price for F75 MIM powder has risen sharply, with quotations now ranging between US$100–150 per kilogram, depending on specification and particle size distribution.

This cost pressure is expected to persist as long as cobalt remains above historical averages.

2. 1.4957 Stainless Steel – Indirect Impact

Although 1.4957 is a nickel-chromium-based alloy steel but still have 20% cobalt and does not rely on cobalt as a main alloying element, the ripple effects are still evident:

Alloy price correlation: The surge in cobalt often drives up the broader category of high-nickel and high-chromium alloys.

Smelting cost linkages: Foundries may share furnace capacity and raw material sources for both cobalt and nickel alloys, indirectly raising 1.4957 production costs.

Supply chain reprioritization: Producers might allocate more capacity to cobalt-rich alloys, tightening availability for secondary materials like 1.4957.

In summary, 1.4957 faces moderate but noticeable upward cost pressure due to cobalt’s volatility and the overall inflation in the alloy market.

Cost Transmission Mechanism in MIM Powder Production

The increase in cobalt price doesn’t just affect raw materials — it cascades through the entire MIM powder production process:

Higher alloy feedstock prices

Rising energy and transport costs

Increased quality assurance and inspection requirements

Greater financial stress on working capital due to higher inventory values

Together, these factors have raised the cost base of MIM powder manufacturing by an estimated 15–25% compared to early 2024 levels.

How MIM Manufacturers Can Respond

Implement Flexible Pricing Models

Introduce “metal price adjustment clauses” in long-term contracts to share volatility risk between supplier and customer.Secure Raw Material Supply

Establish forward purchase agreements or strategic stockpiles for critical cobalt-based feedstock.Optimize Product Mix

Focus on higher-margin, high-performance MIM components that justify the added material cost.Enhance Communication Transparency

Keep customers informed through official statements, newsletters, and cost-trend updates — helping them understand that price changes are driven by raw material market dynamics.Develop Alternative Materials

Continue R&D into lower-cobalt or cobalt-free alloy options for non-critical applications.

Conclusion

The global cobalt price surge is reshaping the economics of MIM powder production.

For F75 (Co–Cr) powders and 1.4957 alloy steel with 20% cobalt, the effect is immediate and severe

Both materials now face cost inflation that challenges suppliers and customers alike.

At Lide poweder material, we remain committed to maintaining product quality, transparency, and reliability — even amid these market fluctuations.

Through efficient production management, diversified sourcing, and open communication, we aim to provide our global partners with stable and competitive MIM powder solutions.